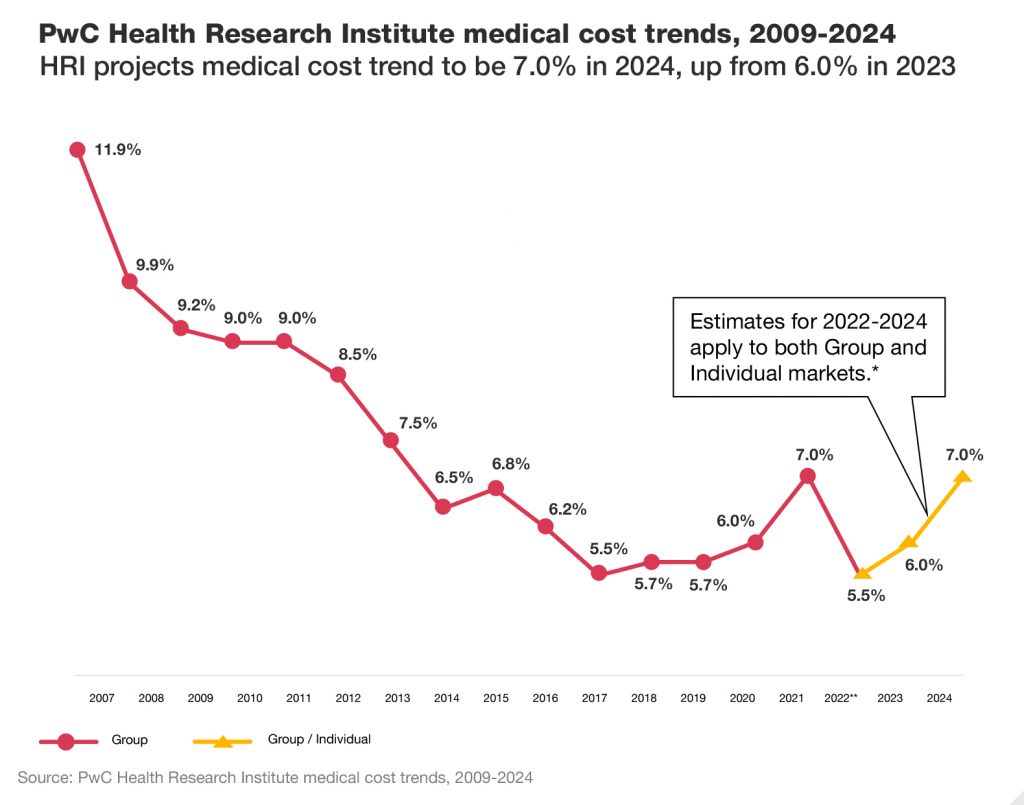

Medical costs are expected to increase 7% in 2024, according to a new report from PricewaterhouseCoopers (PwC). This would match the largest single-year increase since the beginning of the pandemic.

“The higher medical cost trend in 2024 reflects health plans’ modeling for inflationary unit cost impacts from their contracted healthcare providers, as well as persistent double-digit pharmacy trends driven by specialty drugs and the increasing use of the GLP-1 agonists for Type 2 diabetes or weight loss,” the report said.

As national medical trend goes, we’ve come a long way from the double-digit spikes of the early 2000’s. However, annual trend is slowly working its way back up, and with health care inflation expected to double in 2023, this is no time to be complacent. MedBen is here to help.

From 2019 to 2022, MedBen clients experienced a trend of only 2.3% for total gross claim costs (2.1% medical, 3.4% pharmacy). Overall net claim costs also saw just a 2.3% total trend during the four-year period.

Continually coming in under national trend doesn’t happen by accident, and for clients who are willing to make important decisions about their health plan, we can help them take advantage of savings opportunities whenever they arise. It may be a new reimbursement strategy, assistance to counter high-cost specialty drugs, a focused wellness program… or a combination of solutions.

“There isn’t an ‘Easy’ button,” explained Brian Fargus, MedBen Vice President of Sales and Marketing. “But there are targeted approaches that plans can implement to control costs and preserve benefits.”

In this year’s MedBen Client Report, we look at some of the services we offer to reduce your health care spend while preserving or improving your benefits. If you haven’t read it we encourage you to do so, and call us if you have any questions.