Self-funding offers superior savings over fully-insured health plans… but that is just the half of it. Equally important is having the right tools to take advantage of self-funding’s strengths.

For 30-plus years, MedBen has been delivering industry-leading claims management approaches, innovative plan design strategies, transparent, pass-through pharmacy solutions, integrated wellness programs, and superior customer service.

Self-funding saves. MedBen delivers.

Savings through Self-funding

Claims Management

Alternative Reimbursement Strategies

MedBen Rx

MedBen Analytics

MedBen WellLiving

Client Services

Peace of Mind

DELIVERING…

Savings through Self-funding

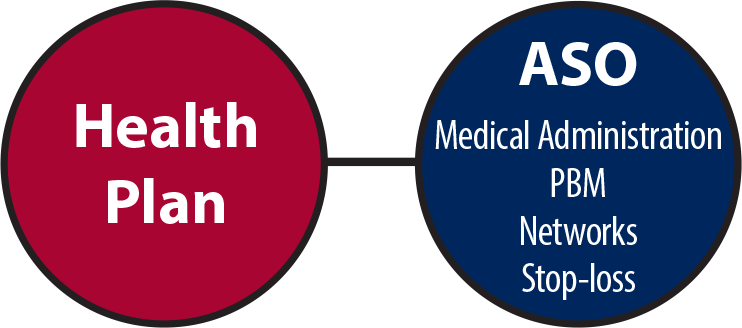

Self-funding saves, but how you self-fund also matters. Maximizing value calls for the right administrator… and there’s a crucial distinction between ASO organizations and the third party administration that allows MedBen to deliver real self-funded savings.

Administrative Services Only (ASO) organizations are typically run by large insurance carriers who package their medical administration with other services operated by the same company… so if you’re “saving” money in one area, there’s a good chance you’re paying it back in another.

With MedBen third party administration (TPA), clients have the ability to select from different vendors who compete for their business. MedBen helps you build the best plan design and cost saving solutions… we help you choose the best option for you.

Self-Funding Saves

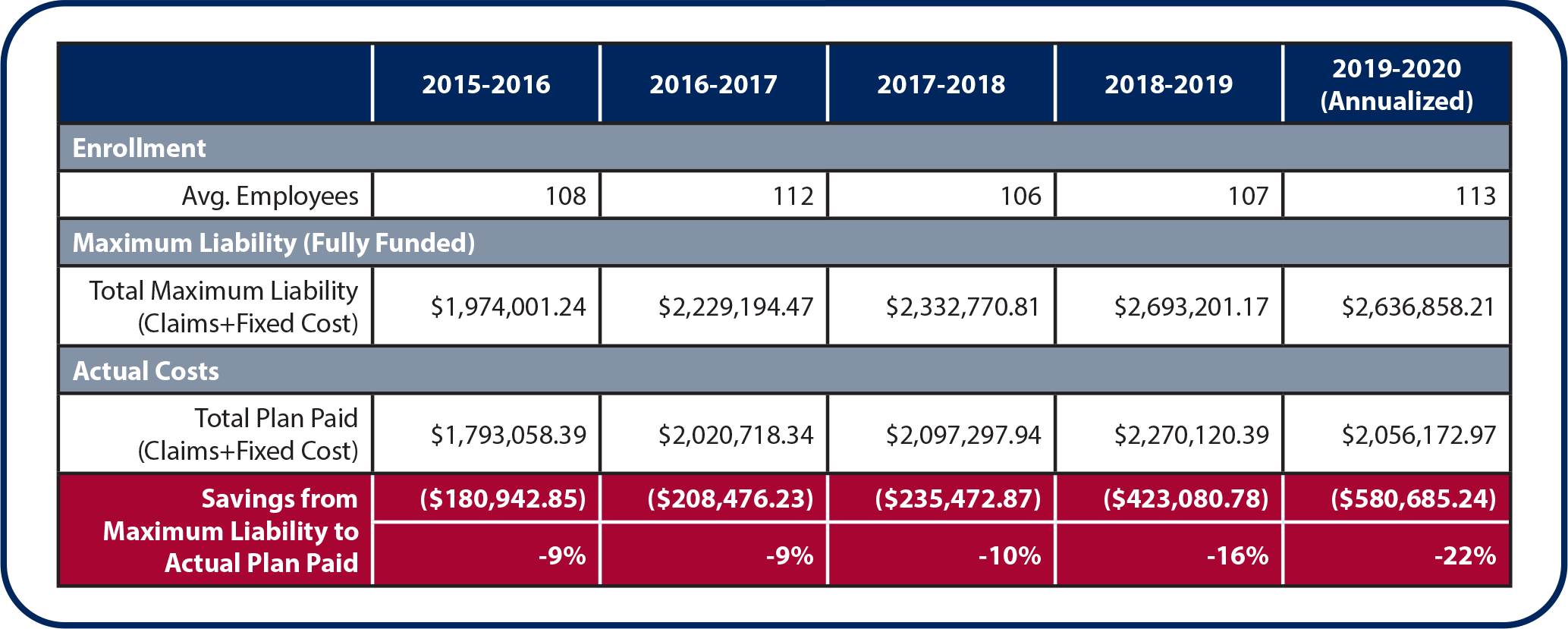

In this case study, we examine a MedBen self-funded client’s actual costs against their fully-funded maximum liability, which is often used to compare the same coverage to fully-insured rates.

$1,628,658

Five-year savings that stays with the employer and NOT a carrier.

DELIVERING…

Claims Management

Good claims management takes more than just auto-adjudication and getting the payment out the door. Real claims savings requires that you pay the right price only for the services necessary… and don’t get locked into contracts that prevent a thorough claims review. This is how MedBen claims management delivers.

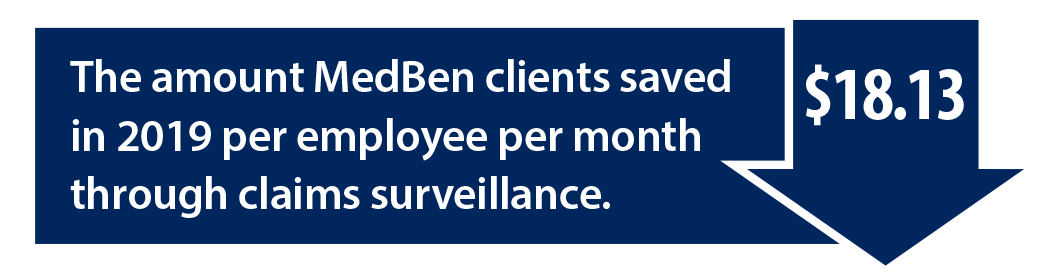

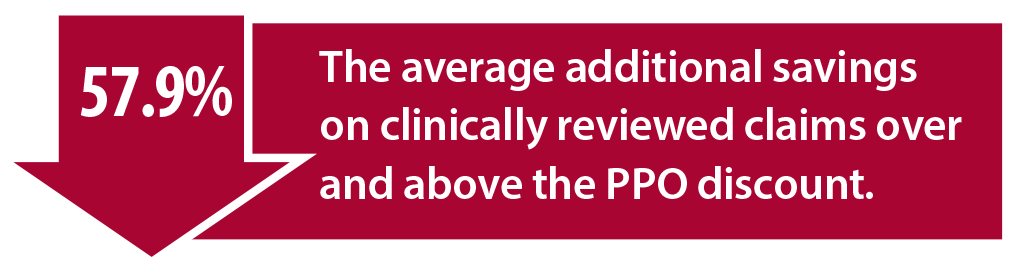

MedBen utilizes an advanced surveillance system of thousands of physician-developed algorithms which audit claims clinically and financially.

Five years ago, per-employee client savings was $12.56… which means in five years the average savings has increased by 44.3%.

Looking back five years, reviews saved clients 41.6%… so we’ve seen the gap widen by 16.3% over that period.

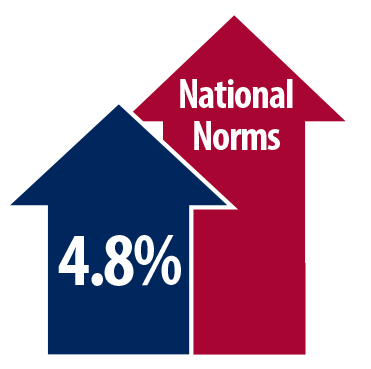

Through MedBen’s claims management strategies, clients’ claim costs per employee trended at 4.8% between 2016 and 2019… well below national norms.

DELIVERING…

Alternative Reimbursement Strategies

Self-funding offers employers the flexibility and independence to better manage health care costs through alternative reimbursement strategies, like direct-to-employer contracting where health systems partner with health plans to lower cost and improve care. Or reference-based pricing that affords employers the opportunity to reimburse according to Medicare pricing.

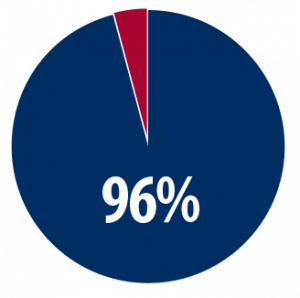

MedBen clients who use direct-to-employer (DTE) contracting or reference-based pricing (RBP) spend on average 24.7% less than traditional PPO plans.

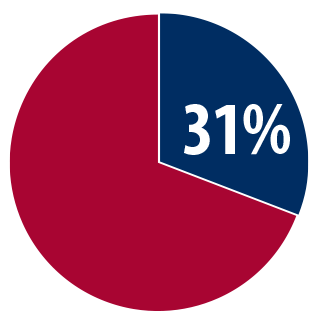

31% of MedBen clients now use direct-to-employer contracting or a reference-based pricing reimbursement strategy.

DELIVERING…

Transparency is important in the pharmacy benefits world – there are too many games and hidden costs. But to save money you also need an independent pharmacy benefits manager that passes through all savings and 100% of rebates. This is rare in a world where health insurance companies use PBMs as another profit line. But it is where MedBen Rx delivers.

MedBen Rx clients spend on average 14.8% less than other PBMs.

MedBen Rx clients spend 12.0% less on average cost per script (brand and generic combined) than other PBMs.

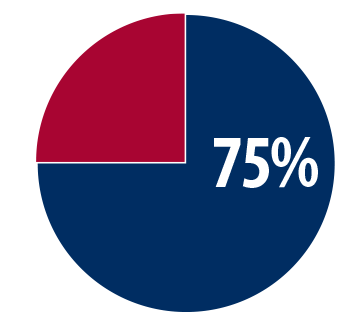

75% of MedBen clients currently use MedBen Rx.

DELIVERING…

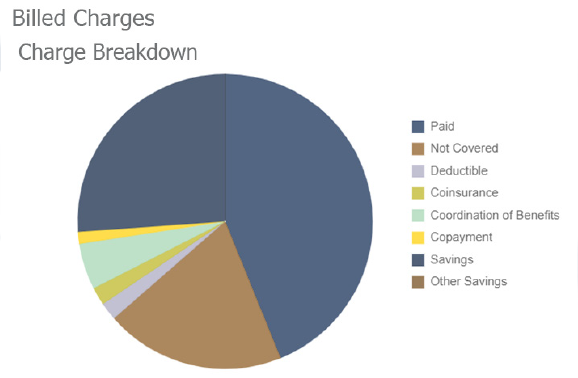

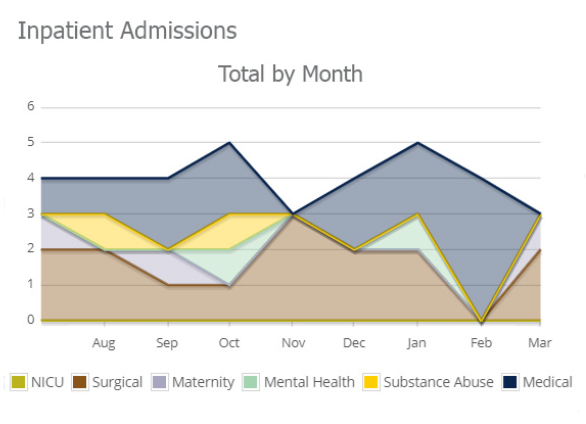

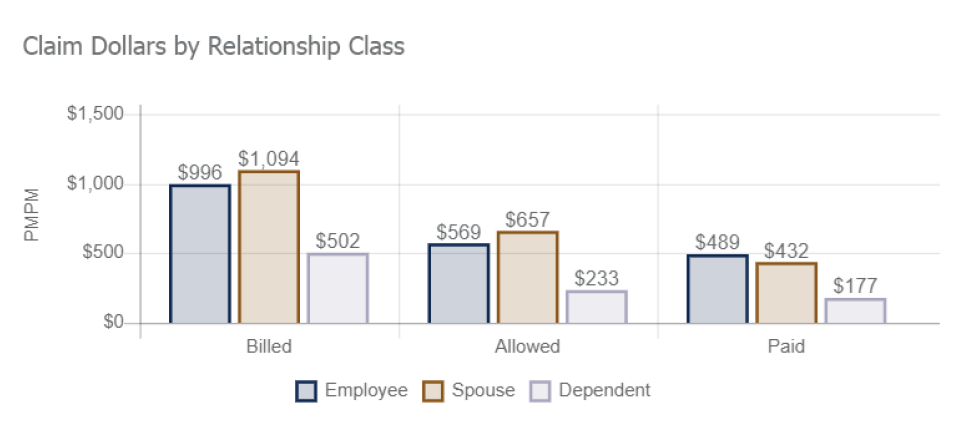

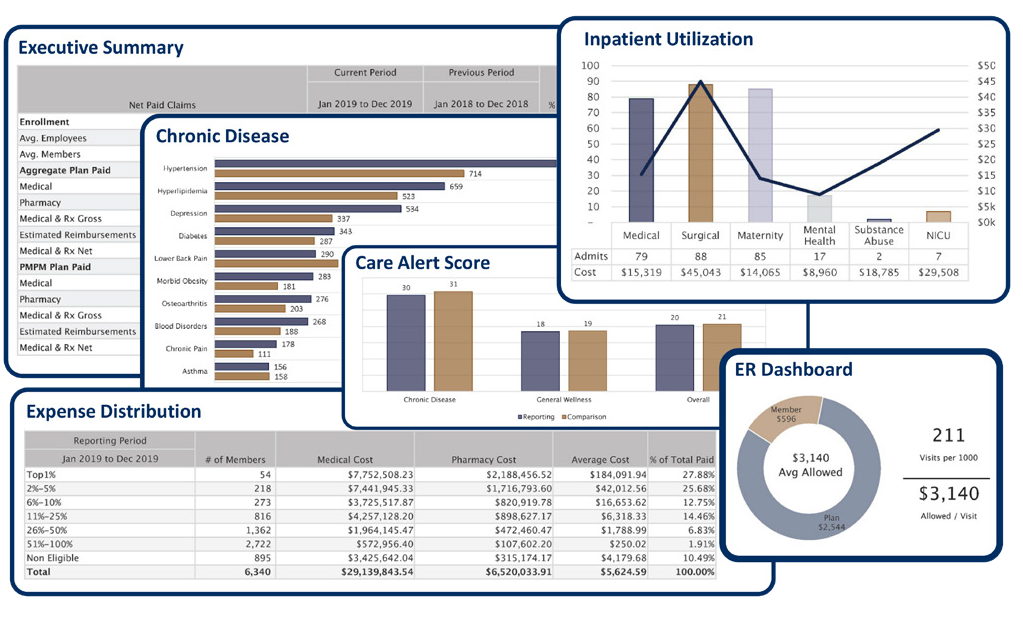

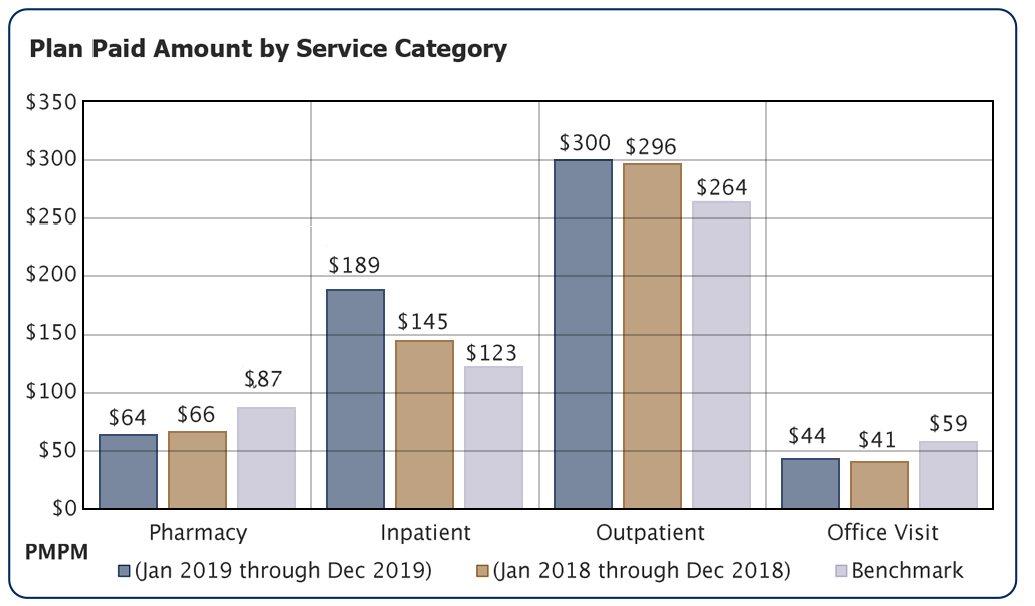

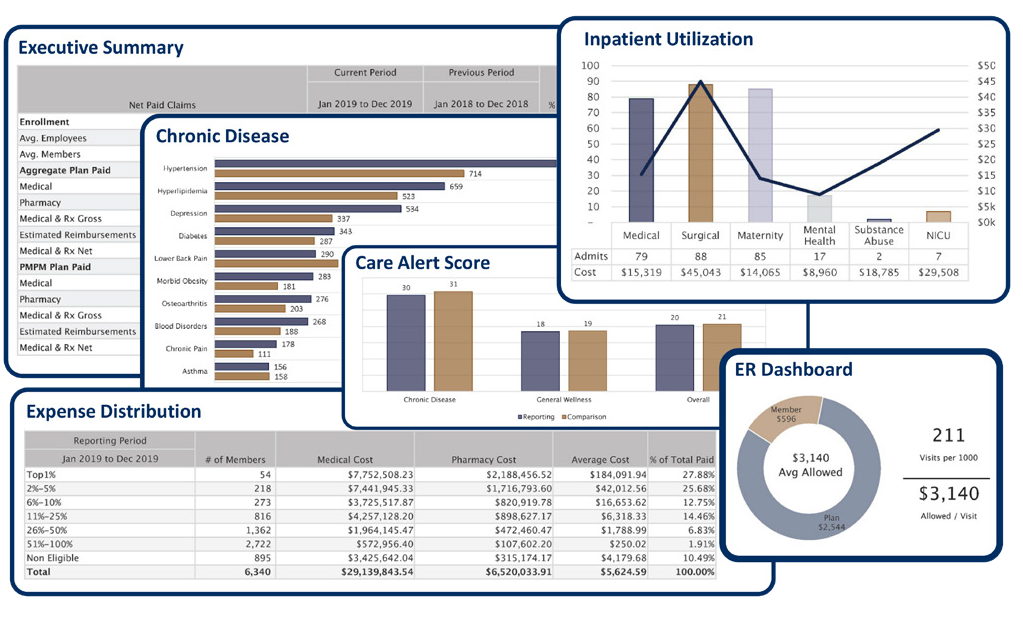

Managing a health plan requires insight. Insight for health plans requires information combined with a deep understanding of employee benefits. This is where MedBen Analytics delivers for our clients.

MedBen Analytics offers actionable reports that show you what is working with your plan while highlighting areas of potential improvement… and greater savings.

MedBen Analytics’ benchmarking capabilities enable you to compare your data against and national norms and/or specific industries. You can also narrow your reporting by plan type, number of lives and other metrics to get a true measure of how your plan stacks up.

The MedBen Analytics employer dashboard offers a dollar-and-cents snapshot that shows you where your plan has been, where it is, and where it’s going.

Using the dashboard, employers can review medical and pharmacy activity and find opportunities to improve population health and reduce overall costs. This intuitive and integrated approach offers insights that save you money and maximize your plan value.

DELIVERING…

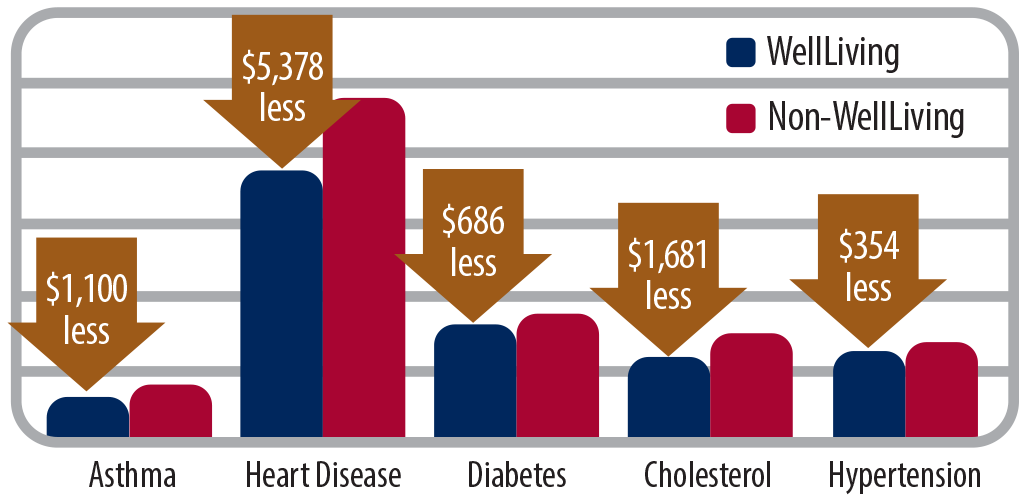

It makes sense. Structure a wellness/disease management program that encourages members to get preventive screenings from physicians in order to identify and manage chronic and potentially catastrophic conditions early, and you will improve plan performance and employee health. Wellness saves and MedBen WellLiving delivers.

Through early detection and prevention of chronic conditions, MedBen WellLiving clients spend an average of 7.6% less compared to those who don’t use WellLiving.

MedBen WellLiving clients spend less

per member on all major chronic conditions.

45% of MedBen clients currently use MedBen WellLiving.

From 2016 to 2019, MedBen WellLiving clients saw a significantly lower trend and claim costs compared to clients who didn’t use our wellness program.

From year to year, MedBen WellLiving clients spent less than non-WellLiving clients… a trend we expect to continue.

In 2019, WellLiving clients spent $1,031 less per employee than those who didn’t use WellLiving.

DELIVERING…

Client Services

Service means being there when you are needed with the right information and guidance. Employers don’t often think about benefits – it isn’t what they’re supposed to think about. MedBen thinks about benefits all the time, and we’re there when you need us.

DELIVERING…

Peace of Mind

Peace of mind is our goal. The proper combination of information and performance. But you determine whether we have accomplished that. If we have, you have our commitment that we will keep working at it. If we haven’t, call us.

![]()

In our current climate, the rules change fast. MedBen Compliance helps you stay ahead of state and federal legislation that affects your plan.

![]()

MedBen uses extensive information privacy and security safeguards to ensure that only those who need personal data to do their job can see it.

Self-funding Saves. MedBen Delivers.

Download the MedBen Client Report

Please register to download the Client Report. Thanks!

Benchmarking

MedBen Analytics' benchmarking capabilities enable you to compare your data against state and national norms and/or specific industries. You can narrow your benchmarks by plan type, number of lives and other metrics to get a true measure of how your plan stacks up.

Your benchmarking choice is immediately reflected on the dashboard content.

Straight RBP

Providers receive fair reimbursement by using Medicare pricing as the primary source of repricing. And because your plan no longer has a PPO, your plan members can go anywhere they choose for medical care.

Pharmacy Cost Plus Pricing

RBP for your prescription drugs.

Layered RBP

Target high-cost medical treatments, such as kidney dialysis.

An Extensive Reporting Library

Once you've chosen your population, reporting period and benchmark preferences, just sit back and watch MedBen Analytics go to work for you. Dozens of charts, graphs and tables, instantly generated. Our financial, clinical, risk and savings reports show you what is working with your plan while highlighting areas of potential improvement.

FSA Store is the largest online marketplace for guaranteed FSA-eligible products, helping flexible spending account holders manage and use their FSAs and save on more than 4,000 health items using tax-free money. You can pay for purchases using your MedBen FSA debit card so they are automatically noted on your account balance.

FSA Store is the largest online marketplace for guaranteed FSA-eligible products, helping flexible spending account holders manage and use their FSAs and save on more than 4,000 health items using tax-free money. You can pay for purchases using your MedBen FSA debit card so they are automatically noted on your account balance.

Use these convenient links for finding FSA-eligible products and calculating your FSA tax savings. FSA members can check their current account balances by visiting MedBen Access or downloading our mobile app from the Apple App Store or Google Play (search for "MedBen").

Use this secure 24/7 service portal to access claims and benefits information. MedBen Access enables you to:

- Check claims status

- Review benefit coverages

- Download explanations of benefits (EOBs)

- See deductibles, out-of-pocket costs and calendar maximums

- Look up drug information, compare local pharmacy prices and check availability of lower-cost equivalents

- Review FSA and HRA activity and balances

- Check wellness exam and screenings compliance (for WellLiving members)

If you need assistance logging in to MedBen Access or using its features, please contact MedBen Customer Service at 800-686-8425.

MedBen Access is also available as a mobile app with the same great features! Download it from the Apple App Store or Google Play (search for "MedBen").

Download the MedBen Client Report

Please register to download the Client Report. Thanks!

Frequently Asked Questions about using the debit card (PDF).

Download a list of participating pharmacies, discount stores and supermarkets that can identify FSA-eligible items at checkout using an Inventory Information Approval System (IIAS).

Download a list of participating pharmacies, discount stores and supermarkets that do not use IIAS, but 90% of whose sales come from medical care items (thus making them FSA-eligible).

Medical Solutions.

MedBen will work with your clients to find the best solution to meet specific employee population needs. Increasingly, organizations are going outside the PPO box and turning to direct-to-employer contracting, reference-based pricing, and other alternative reimbursement strategies with set pricing that makes it easier to predict expenses. And their members can visit the doctors they prefer and still realize lower out-of-pocket costs.

Pharmacy Solutions.

MedBen will work with your clients to find the best solution to meet specific employee population needs. Increasingly, organizations are going outside the PPO box and turning to direct-to-employer contracting, reference-based pricing, and other alternative reimbursement strategies with set pricing that makes it easier to predict expenses. And their members can visit the doctors they prefer and still realize lower out-of-pocket costs.

Medical Solutions.

MedBen will work with your clients to find the best solution to meet specific employee population needs. Increasingly, organizations are going outside the PPO box and turning to direct-to-employer contracting, reference-based pricing, and other alternative reimbursement strategies with set pricing that makes it easier to predict expenses. And their members can visit the doctors they prefer and still realize lower out-of-pocket costs.

Pharmacy Solutions.

MedBen Rx follows a simple philosophy: The client's money belongs to the client. Our pharmacy solutions are designed to get members the right drug at the lowest cost, with total transparency to the employer. These include:

- Pricing solutions that ensure clients pay just what the pharmacies pay.

- Appropriateness solutions to find the most effective drugs at the best cost.

- Access solutions that give members new ways to lower their drug cost.

Direct-to-Employer Contracting

Many MedBen clients blend their RBP plan with direct-to-employer (DTE) contracts, which promote the use of quality care through local providers. In exchange for encouraging members to visit contracted facilities, providers bill the plan at mutually agreed-upon rates.

MedBen has been facilitating DTE contracting for over a decade with doctors and hospitals across the Midwest, and we continue to gain access to more exclusive DTE contracting. This strategy ensures that when members utilize area providers, they receive the best pricing options available.

“The speakers were excellent along with topics that are important and at the forefront in our industry. Very good event!!!”

“Very happy with what I learned and I look forward to using my new knowledge immediately.”