Have you ever received a larger-than-expected stop-loss premium increase and your carrier blamed “leveraged trend”? Well, here’s what they mean.

The fact that rising claim costs contribute to higher plan costs may be self-evident… but not just in ways that are readily apparent. As a new stop-loss premium survey explains, the effect of medical inflation on stop-loss reimbursements can result in a condition known as “leveraged trend.”

“[Leveraged trend] occurs as the underlying increase in expense of a catastrophic medical claimant is fully borne by an unchanged stop-loss deductible from one year to the next,” the survey report said. In other words, if your specific deductible fails to keep up with annual medical trend expectations, the leveraged trend escalates and you may end up paying more in the long run.

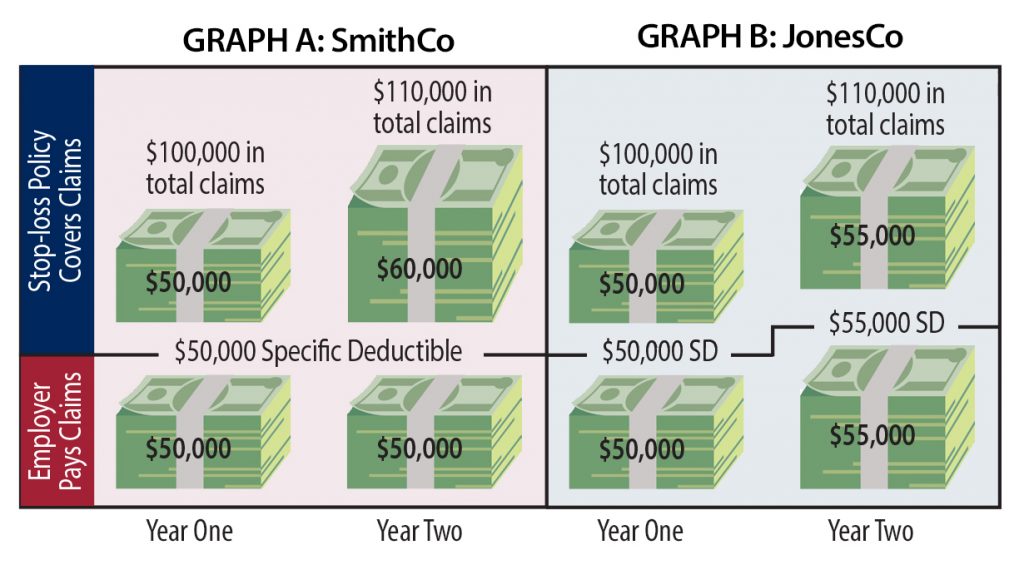

Here’s a sample comparison of how two companies approached ‘the “leveraged trend effect”:

GRAPH A: In Plan Year One, SmithCo has $100,000 in claims with a $50,000 specific deductible. $50,000 is paid by the employer, while the remaining $50,000 is reimbursed through SmithCo’s stop-loss policy.

In Plan Year Two, medical trend increases 10%, but SmithCo keeps the same $50,000 specific deductible. SmithCo also has the same number of claims as Year One – but with trend, their total cost goes up 10% to $110,000. So SmithCo pays the same $50,000, but the stop-loss carrier now pays $60,000. That represents a 20% leveraged trend increase – and is why SmithCo’s future premiums may exceed claims trend.

GRAPH B: JonesCo also has a $50,000 specific deductible and $100,000 in claims during Plan Year One – but aware of the expected 10% medical cost bump, JonesCo raises its specific deductible to $55,000 in Plan Year Two… an additional 10%, in line with trend.

Plan Year Two claims activity for JonesCo is the same as SmithCo, but JonesCo pays $55,000 and the stop-loss carrier pays the balance of $55,000. By increasing the specific deductible in accordance with trend expectations, JonesCo stands to see smaller stop-loss premium increases in the future.

MedBen works with clients and carriers to avoid the leveraged trend effect in multiple ways. First and foremost, our risk-reduction strategies help reduce your high end risk to keep your medical trend as low as possible, so you wont have to experience leveraged trend.

Additionally, we shop the stop-loss market to ensure that you’re partnered with the carrier that can deliver the best value for your coverage needs. We’ve worked with best-in-class carriers for over 30 years and can help answer any questions you may have regarding a specific carrier or what products they may have to offer. In short, we take leveraged trend out of the conversation.

If you ever have questions about your stop loss or medical trend, contact your broker or call MedBen at 888-627-8683.