At the MedBen Broker Roundtable on March 16, Vice President of Sales & Marketing Brian Fargus discussed the trend of rising multi-million-dollar claims, and offered a variety of proven solutions.

Citing a recent Sun Life high-cost claims analysis, Fargus said, “In just four short years, the number of million-dollar-plus stop-loss claim reimbursements increased by 37%.” Noting that cancer claims top the list of high-cost claim conditions, he added that cancer screenings fell during the pandemic, so “reinforcing prevention and early detection is important to reducing claim costs.”

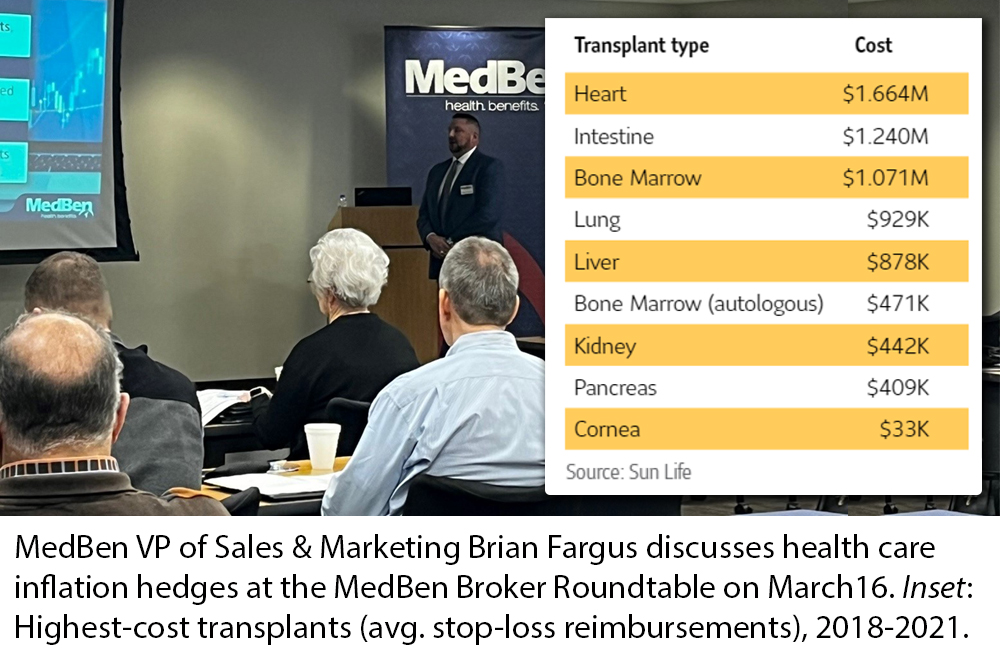

Transplants are also a source of high-cost claims, and can greatly impact a plan’s stop-loss renewal. “A heart transplant alone can cost nearly $1.7 million,” Fargus said, and noted that many plans are limiting risk by adding a transplant carve-out policy.

With multi-million-dollar claims on the rise and looming health care inflation, it’s vital for self-funded employers to take advantage of ways to manage their medical and prescription drug spend. MedBen recently compiled an Inflation Hedge Checklist that offers strategies to reduce risk and lower costs without sacrificing benefits.

We encourage you to download the checklist and call MedBen at 888-627-8683 if you’d like more information about any of the solutions mentioned on the list.