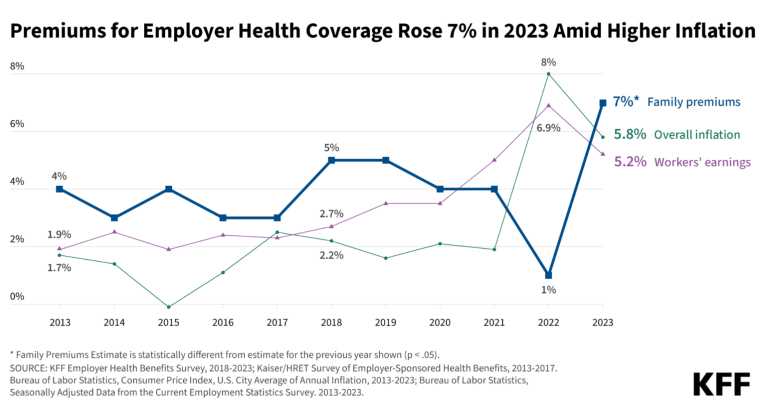

Average annual premiums for U.S. employer-sponsored single and family health insurance coverages both rose 7% in 2023, according to a survey conducted by KFF and published in Health Affairs. While the increase is higher than in recent years, it is generally in line with current inflation (see chart)… and not wholly unexpected following the recent health crisis.

“This is in part due to the decline in use of health services during the COVID-19 pandemic, as well as the end of a prolonged period of very low inflation,” the study’s authors wrote. “There is no way to know whether this is a transient trend or a new pattern in the costs of care.”

The average annual premium for workers covered by their own firms was $8,435 for single coverage and $23,968 for family coverage in 2023. During the past five years, the average premium for family coverage has risen 22% — again, keeping in line with inflation (21%) as well as wage growth (27%).

In a separate report, the Altarum Institute found that national prescription drug spending is outpacing inflation, jumping 10.8% from August 2022 to August 2023. Medication costs have been among the fastest-rising components of health care, so it’s hardly surprising that drug spending has surpassed other categories by a significant margin.

Other findings in the KFF survey:

- Half (50%) of firms with 3-49 workers and 94% of larger firms (50+ workers) offered health benefits to at least some of their workers in 2023.

- For covered workers visiting a primary care doctor in 2023, 68% had a copayment requirement, and 19% had a coinsurance payment. For specialist physician visits, 69% of covered workers had a copayment, and 20% had a coinsurance payment.

- For inpatient hospital services, 63% of covered workers had a coinsurance requirement, 10% had a copayment, and 8% had both. Similarly, 61% had a coinsurance requirement for outpatient surgery, 15% had a copayment, and 7% had both.

- Nearly all employers (91%) covered telehealth services in their largest health plan this year. Looking forward, 41% of companies with 50 or more workers said they believed telemedicine would have a “very important” role when it came to delivering behavioral health care, compared with 27% for primary care and 16% for specialty care.

- Most companies that provide medical coverage also offer separate dental (91%) and vision (82%) coverages. This is a marked increase from 2010, when only 46% of companies offered dental coverage and 17% offered vision.

You can read more about the KFF survey results at HealthCare Dive and Fierce Healthcare.