It is that time of year when self-funded employers need to start preparing for a critical health care reform mandate: Providing the IRS with an accurate accounting of health coverage for full-time employees via IRS Forms 1094 and 1095. And there’s an important change – the manual filing exception is no longer an option.

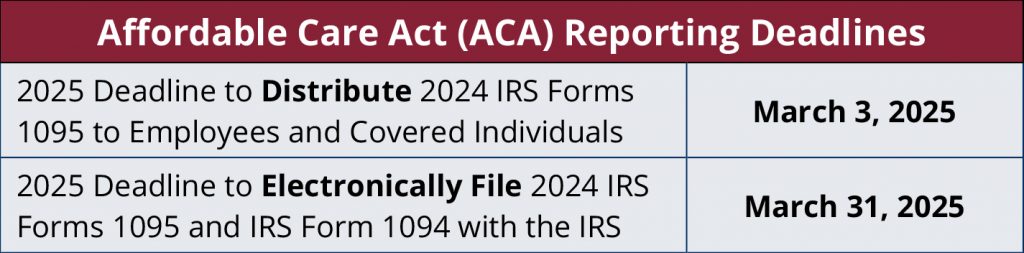

Per the Affordable Care Act, health coverage data collected during 2024 must be aggregated and reported to employees no later than March 3, 2025, on IRS Form 1095 and reported electronically to the IRS no later than March 31, 2025, on IRS Form 1094. Applicable Large Employers – ALEs (those with 50 or more employees) must report using the IRS’ C-series forms and small employers offering coverage (those with fewer than 50 employees) must report using the IRS’ B-series forms.

All Employers – both large and small employers under the ACA – must now file their IRS Forms 1095 along with the IRS Form 1094 electronically. There is no longer a manual filing exception for small employers.

MedBen has again partnered with MyBenefitsChannel – also known as Sanorbix – to provide reporting assistance for ALE clients. MyBenefitsChannel has several service options available to help ALEs create and distribute Form 1095-C to employees and prepare and file Form 1094-C with the IRS. MedBen will also be available to assist clients who are small employers by offering IRS Form 1095-B – employee notice preparation, and Form 1094-B – IRS transmittal services for a nominal fee. MedBen’s B-Series services include form both preparation and B-series electronic submission to the IRS.

As in years past, we recommend that our clients purchase these services as soon as possible.

- If you purchased these services from MyBenefitsChannel last year, you will get renewal information directly from MyBenefitsChannel if you have not already received it.

- If you wish to purchase these services from MyBenefitsChannel for the first time, please contact your MedBen Account Management Team immediately.

- If you are planning to create these forms yourself or working with another vendor, we would appreciate knowing that too.

Regardless of your preferred approach, it is important that you start planning now. If you need more information on these requirements, or if you have questions, contact your Account Management Team or Director of Compliance & Human Resources Erin Kelly at 740-522-7368.